Imagine having a couple million in the bank… and still thinking twice about ordering dessert.

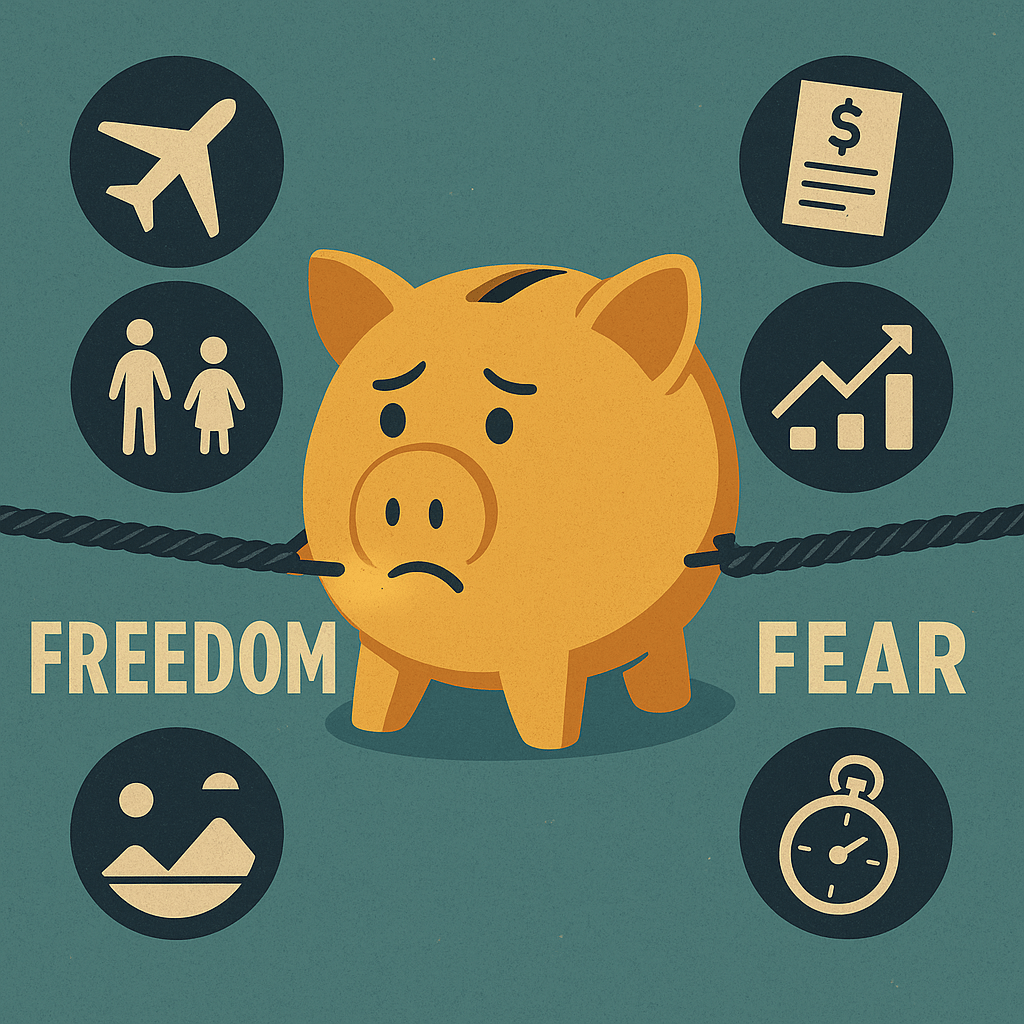

Well, that happens to be the reality for a surprising number of retirees today—especially wealthy ones. Despite having robust “nest eggs,” many are living like they’re scraping by. It’s an abnormality that researchers have dubbed the “retirement consumption puzzle.” And at its core, it’s rooted in one powerful, intoxicating emotion: fear.

Retirement Isn’t the Party It Was Supposed to Be

Visions of grandeur dance in the mind of many when they imagine retirement, seeing it as the long-awaited reward after decades of hard work. Travel. Leisure. Maybe some extra time to spoil the grandkids. But for many baby boomers—especially those who weathered multiple market crises—retirement looks a little different. No question, if you were to live to see as much as they did, it comes as no surprise.

New research by David Blanchett and Michael Finke shows that retirees are only withdrawing about 2.1% of their retirement savings each year. Why? Because they’re scared. They’re deathly afraid of running out of money. Scared of what might happen if inflation surges or medical bills hit hard in their 80s or 90s.

Yes, even those with seven-figure portfolios are choosing caution over comfort.

Why the Fear? Three Words: Longevity, Inflation, and Uncertainty

Unfortunately, it’s not all paranoia—it’s math.

The fact of the matter is Americans are living longer than ever. Let’s say you retire at 65, there’s a decent chance you’ll need your money to last 30 years or more. At the same time, expenses like healthcare, housing, and basic necessities have all climbed dramatically. Fidelity estimates that a retired couple today will need over $315,000 just to cover healthcare expenses in retirement – that’s astonishing.

Add in recent volatility in the market, economic uncertainty, recent headlines stemming from the new administration, and the rising cost of living, and it’s no wonder even confident savers feel the urge to play it safe.

Not Everyone Is Sitting on a Fortune

I think it’s very important to note that, while boomers may control over half of America’s wealth, the median retiree isn’t living like it. In fact, 43% of Americans aged 55-64 had no retirement savings at all in 2022. And about 30% of people over 65 were considered “economically insecure,” according to federal data.

The result? Many are working longer—or heading back to work altogether. Ideally, we strive for “work optional.” But it’s becoming much harder to make it optional for so many Americans.

The Rise of “Unretirement”

The idea of “unretiring” is no longer just a trend. It’s a very real thing for many.

Today, nearly 20% of Americans over 65 are still in the workforce, up from just 10% in the late 1980s. Some are doing it because they want to. But many are doing it because they have to. Costs are rising. Portfolios are unpredictable. And for some, part-time work is the only way to bridge the gap.

Whether it’s consulting, side gigs, or part-time jobs, more retirees are saying, “I’m not done yet”—not because they want to work forever, but because they don’t feel financially secure enough not to.

So How Do You Retire Without Fear?

Here’s the truth: If MILLIONAIRES are scared to spend, there’s a lesson in there for everyone. But there are also ways to plan smarter and still enjoy your retirement years without the constant fear of running out. This is WHY we PLAN!

1. Plan to Last for a While

Don’t plan for a 10- or 15-year retirement—plan for 30. That means accounting for healthcare, inflation, and lifestyle changes well into your 90s. If the idea that you must plan to live that long doesn’t hit home enough for you, perhaps considering your legacy will. Anything in excess can go to your spouse and your loved ones with the right planning. Planning to stretch your money matters.

2. Be Flexible with Your Withdrawal Strategy

Consider adjusting your withdrawals based on personal needs. Guardrail strategies and dynamic withdrawal rates can be powerful tools. This is why it’s absolutely paramount to have an understanding of what your lifestyle requires. Your withdrawal rate is personal to you, steer away from the general guides on this component, like the “4% Rule”, as what works for someone else might not work for you.

3. Find a Balance with Your Conservatism

There’s a fine line between being smart and being scared. Being too cautious can lead to missed opportunities—and a retirement that feels more like survival than freedom. No one wants that fight-or-flight sensation in your golden years. Being too cautious can cost you, being too risky can cost you. All the more reason to take the time to understand your risk tolerance and finding that balance. Education here is key.

4. Secure Your Income

If you can afford to have establish multiple streams of income, it never hurts to seize that opportunity. But most important is the insurance that that income is relatively guaranteed, predictable, and stable. We can think of things like rental income, dividends, part-time work, or annuities when looking to diversify retirement income. This way, you’re not relying solely on one source and all of your eggs aren’t in one basket. When it comes to comprehensive planning, the biggest thing you want to do is put a purpose on your money. If you add something that is designated for a specific objective, make sure it stays that way unless you need to pivot in strategy.

In Close…

You worked hard for your money. And while it’s smart to be cautious, it’s also okay to enjoy what you’ve built. The best retirement plans balance security with freedom—and that starts with a strategy that adapts to your life, not just your numbers.

If you’re unsure how to create that balance, that’s where financial planning comes in. We help people make sense of the fear, build plans that last, and ultimately—spend with confidence.

Because retirement isn’t about hoarding your money. It’s about living with peace of mind.

References:

Blanchett, D., & Finke, M. (2025). Retirees Spend Lifetime Income, Not Savings. Retirement Income Institute. Protected Income

Fidelity Investments. (2023). Fidelity Releases 2023 Retiree Health Care Cost Estimate. Fidelity Newsroom

Pew Research Center. (2023). Older Workers Are Growing in Number and Earning Higher Wages. Pew Research Center

Federal Reserve Board. (2022). Economic Well-Being of U.S. Households in 2021 – Retirement and Investments. Home

AARP. (2022). Survey: Older Adults Planning to Work in Retirement for Financial Reasons. Blogs

We are an independent firm helping individuals create retirement strategies using a variety of insurance products to custom suit their needs and objectives. This material is intended to provide general information to help you understand basic retirement income strategies and should not be construed as financial advice.