Experts have famously tabbed it as, “the worst of both worlds.” If you’ve been following recent economic headlines, you may have heard whispers of a potential return of “stagflation.” It’s a term that sounds ominous — and for good reason. But what is stagflation, and how likely is it that we’ll see it in today’s economy?

What Is Stagflation?

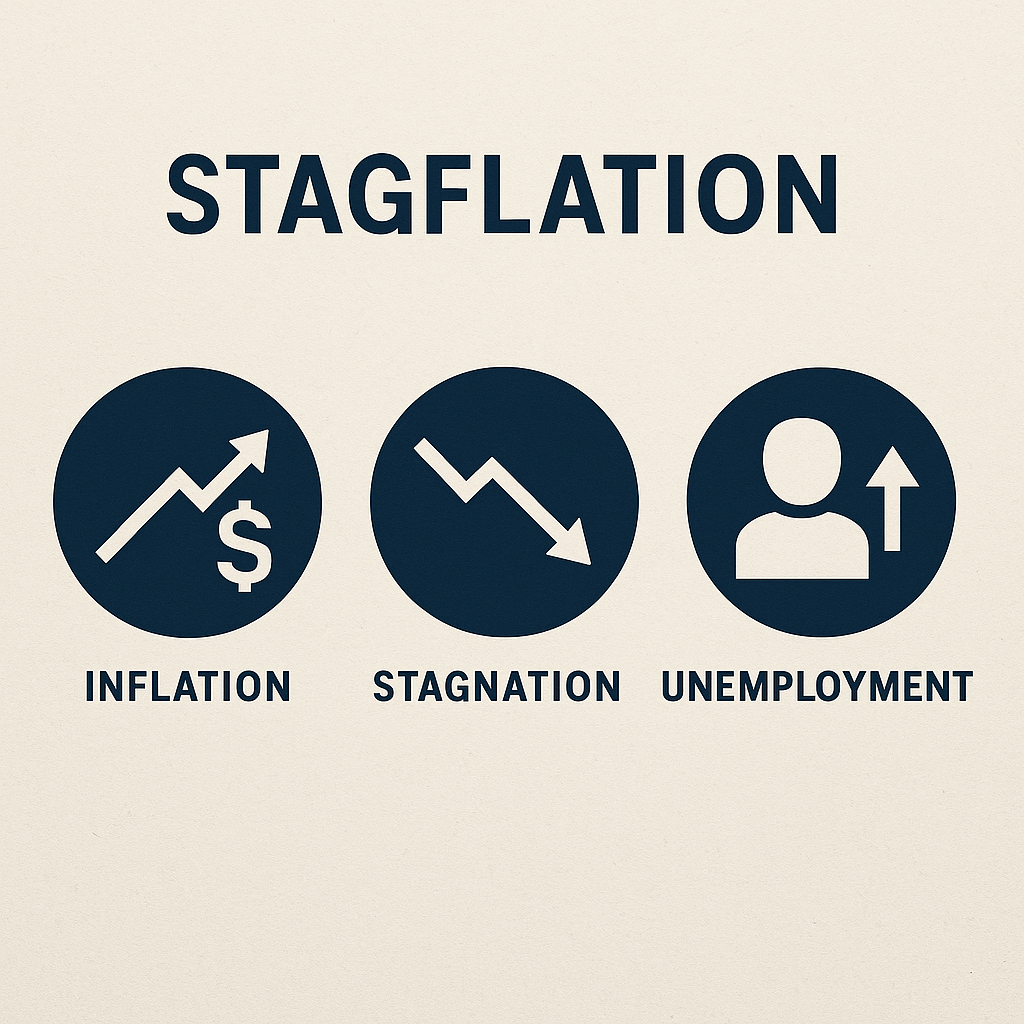

Stagflation is a unique and challenging economic condition where high inflation is paired with stagnant economic growth and high unemployment. These three forces rarely occur together, and when they do, they put policymakers and consumers in a difficult position.

In simpler terms, imagine prices going up across the board while wages stay flat and job opportunities shrink. That’s the stagflation trifecta — and it’s a situation no one wants to find themselves navigating.

A Historical Perspective: The 1970s Stagflation

To understand stagflation, it’s helpful to look back at the 1970s—a decade when the U.S. economy experienced this rare phenomenon. Several factors contributed to the stagflation of that era:

- Oil Price Shocks: In 1973 and again in 1979, oil prices surged due to geopolitical tensions and OPEC’s oil embargoes. These shocks led to increased production costs and higher consumer prices.

- Monetary Policies: Efforts to control inflation through monetary policy were initially ineffective, leading to persistent inflation and economic stagnation.

- Unemployment and Inflation Rates: During this period, the U.S. saw inflation rates averaging around 7% annually, with peaks exceeding 13%. Unemployment also rose, reaching over 8% in the mid-1970s.

This combination of factors created a challenging economic environment, with slow growth, rising prices, and increasing joblessness.

Why Are People Talking About It Now?

Back in 2022, a survey found that 80% of economists viewed stagflation as a long-term risk. But strong economic growth, falling inflation (a trend known as “disinflation”), and a solid labor market helped stave it off at the time.

Fast forward to today, and concerns have resurfaced. The economy entered 2025 in solid shape, but recent shifts — particularly surrounding labor markets, global trade, and fiscal policy — have reignited conversations about the potential for stagflation.

It’s important to note: while some economists see warning signs, others remain cautiously optimistic. Factors like consumer spending, labor participation, and inflation expectations will all play a role in determining the path forward. Already there are some positive trends going in the right direction, such as the recent April CPI reading that saw it increase lower than what economists were expecting.

What Could Help Prevent It?

Historically, stagflation has been difficult to manage because typical tools used to fight inflation (like raising interest rates) can further slow economic growth. That’s why prevention is key.

Economists point to several levers that could reduce the risk of stagflation:

- Policy clarity and stability: Reducing uncertainty in regulations and policy direction can help businesses plan and invest with more confidence.

- Labor market flexibility: Ensuring a strong, well-supplied workforce is key to sustaining economic growth.

- Trade relationships: Stable and open trade policies can help keep supply chains flowing and prices more stable.

These are broad economic considerations, and while they can’t eliminate risk entirely, they can contribute to a more resilient environment.

What This Means for Everyday Investors

As financial professionals, we believe it’s important to stay informed without overreacting. Economic uncertainty can cause unease, but your financial plan should be designed with long-term resilience in mind.

The possibility of stagflation may be a headline today, but that doesn’t mean it’s your financial future. Instead of trying to predict the next macroeconomic turn, focus on what you can control:

- Know your goals.

- Understand your risk tolerance.

- Stay diversified.

- Keep reviewing your plan in light of new information.

At Mediate Financial Services, we’re here to help you do just that.

Have questions about how current economic trends could impact your retirement or investment strategy?

Schedule a call with our team today. We’re committed to helping you navigate uncertainty with clarity and confidence!

References:

Federal Reserve History. The Great Inflation (1965–1982). Federal Reserve History

Investopedia (2024). Stagflation in the 1970s . Investopedia

U.S. Department of State. Oil Embargo, 1973–1974. Office of the Historian, U.S. Department of State

Investopedia (2024). Historical U.S. Unemployment Rate by Year. Investopedia

We are an independent firm helping individuals create retirement strategies using a variety of investment and insurance products to custom suit their needs and objectives. This material is intended to provide general information to help you understand basic retirement income strategies and should not be construed as financial advice. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.