On May 16, Moody’s made a call that turned a lot of heads: it downgraded the U.S. government’s credit rating from Aaa to Aa1.

If you’ve been watching the headlines since then, you already know how this went. The media jumped on it, pundits lined up to declare economic doom, and investors braced themselves for a turbulent week.

But let’s slow down for a second and look at what this actually means.

What Is a Credit Downgrade, Really?

If you’ve ever checked your credit score, you already understand the basics. The U.S., for decades, has been like a borrower with a pristine 800 score—high income, reliable history, strong reputation. Lenders were happy to extend credit.

But just like any credit card user who racks up too much debt, we’re starting to raise a few eyebrows. Moody’s downgrade is essentially their way of saying, “We’re still confident in you, but we’re watching more closely now.”

So yes, it’s a downgrade. But we didn’t go from straight-A student to drop-out. More like 800 to 780. Still very good. Still reliable. Just a little ding on the record.

How Did the Market React?

Surprisingly calmly.

The Dow dropped 300 points when the news hit, then climbed back and finished the day higher. Bond yields spiked briefly before leveling off. The U.S. dollar? Barely moved.

Why? Because while this headline is dramatic, the underlying fundamentals haven’t suddenly changed. The U.S. economy is still the largest and most dynamic in the world. Our military, infrastructure, and innovation capacity remain unmatched. Investors know that.

Why This Still Matters

Even though this isn’t a reason to panic, it’s not meaningless.

When the government’s borrowing cost goes up, it affects a lot more than just Capitol Hill. It trickles into:

- Mortgage rates

- Car loans

- Credit card interest

- Small business financing

In short, the cost of borrowing could rise across the board. That impacts households in places like Des Moines just as much as it affects Wall Street traders.

Are There Any Silver Linings?

Actually, yes.

Higher interest rates tend to create more favorable conditions for savers and income-focused investors. We’re talking about:

- More competitive CD rates

- Higher yields on Treasury bonds

- Better returns in money market funds

So, if you’ve been sitting on cash or reevaluating your fixed income strategy, this could be your window.

What’s Next?

Well, pressure is mounting.

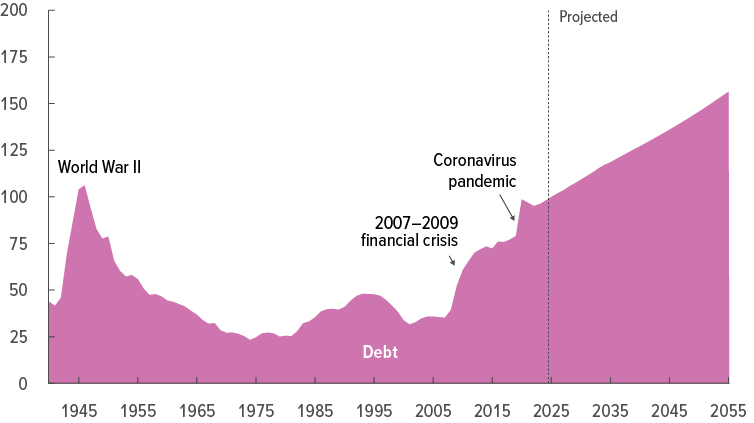

Debt levels are still growing. Politicians are debating new spending proposals. And the more debt we take on, the more we pay in interest. That creates a feedback loop; more borrowing, more cost, more risk of future downgrades.

It also complicates the Federal Reserve’s position. Rate cuts may be slower to come, and market swings could stick around longer than we’d like.

Federal Debt Held by the Public

But here’s the thing…

We’ve Seen This Before

This isn’t uncharted territory.

S&P downgraded the U.S. in 2011. Fitch did it again in 2023. Both caused short-term stir. And yet, long-term investors who stayed the course came out just fine.

The U.S. remains the anchor of the global financial system. The shine may be a bit dimmer, but the foundation is still rock solid.

Bottom Line

This downgrade is a bump, not a breakdown. It’s a reminder to stay aware, but not a reason to overhaul your financial strategy overnight. So, if your long-term goals haven’t changed, your investment strategy might not need to either.

We are an independent firm helping individuals create retirement strategies using a variety of investment and insurance products to custom suit their needs and objectives. This material is intended to provide general information to help you understand basic retirement income strategies and should not be construed as financial advice. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.